2026 Quarterly Tax Calendar List Of. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Tax calendar click here to view relevant act & rule.

Due date for deposit of tax deducted/collected for the month of june, 2025. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. Tax calendar click here to view relevant act & rule.

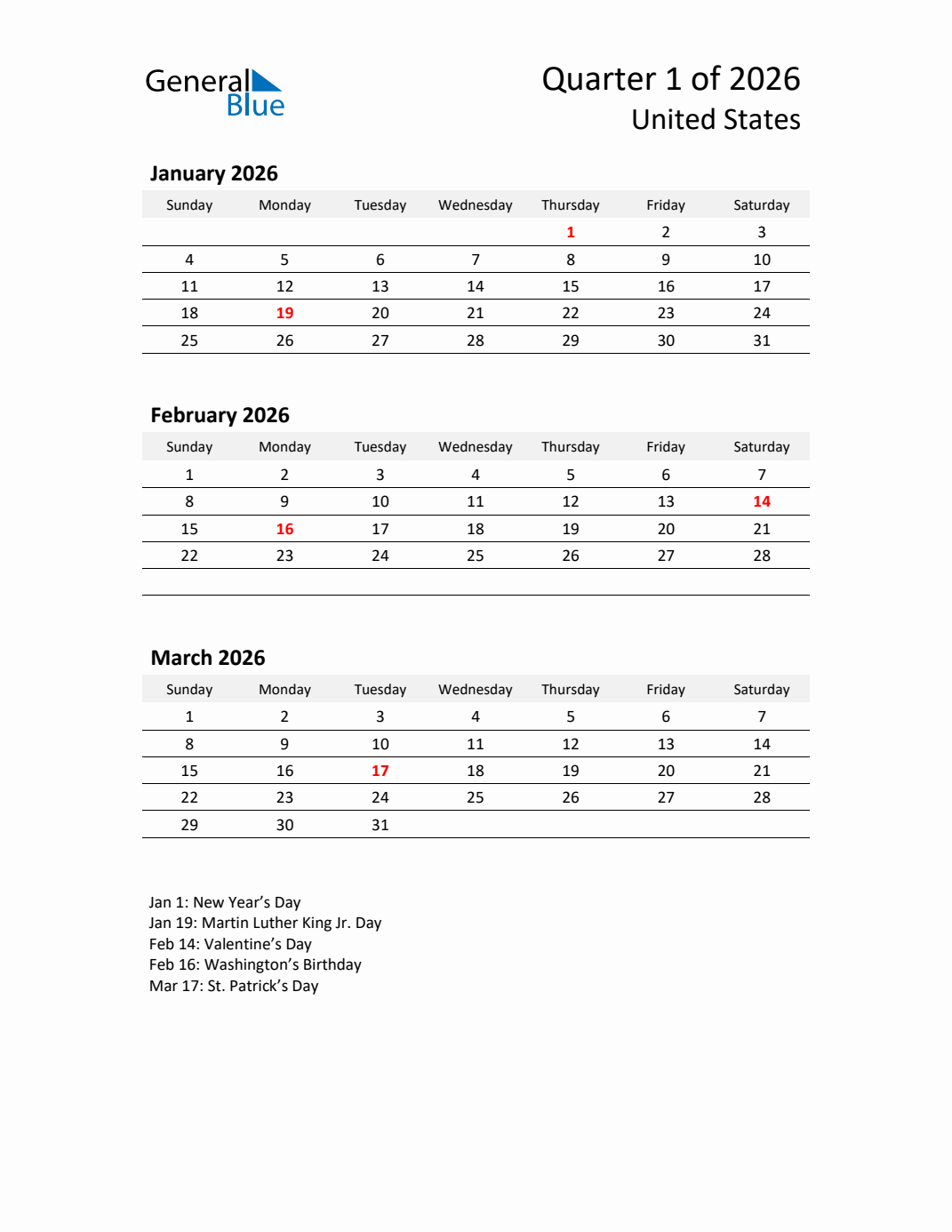

Source: www.generalblue.com

Source: www.generalblue.com

Q1 2026 Quarterly Calendar with United States Holidays (PDF, Excel, Word) In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. Tax calendar click here to view relevant act & rule.

Source: www.generalblue.com

Source: www.generalblue.com

Free Printable Q4 Quarterly Calendar 2026 Due date for deposit of tax deducted/collected for the month of june, 2025. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: www.calendarpedia.com

Source: www.calendarpedia.com

Quarterly Calendars 2026 Free Printable PDF Templates Due date for deposit of tax deducted/collected for the month of june, 2025. The due date for belated and revised.

Source: www.calendarpedia.com

Source: www.calendarpedia.com

Fiscal Calendars 2026 Free Printable Excel templates The due date for belated and revised. Tax calendar click here to view relevant act & rule.

Source: www.alamy.com

Source: www.alamy.com

Quarter calendar template for 2026 year. Wall calendar grid in a A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. The due date for belated and revised.

Source: www.generalblue.com

Source: www.generalblue.com

Q2 2026 Quarterly Calendar with United States Holidays (PDF, Excel, Word) This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. Tax calendar click here to view relevant act & rule.

Source: johndhylton.z13.web.core.windows.net

Source: johndhylton.z13.web.core.windows.net

20252026 Tax Brackets A Comprehensive Overview John D. Hylton Due date for deposit of tax deducted/collected for the month of june, 2025. The due date for belated and revised.

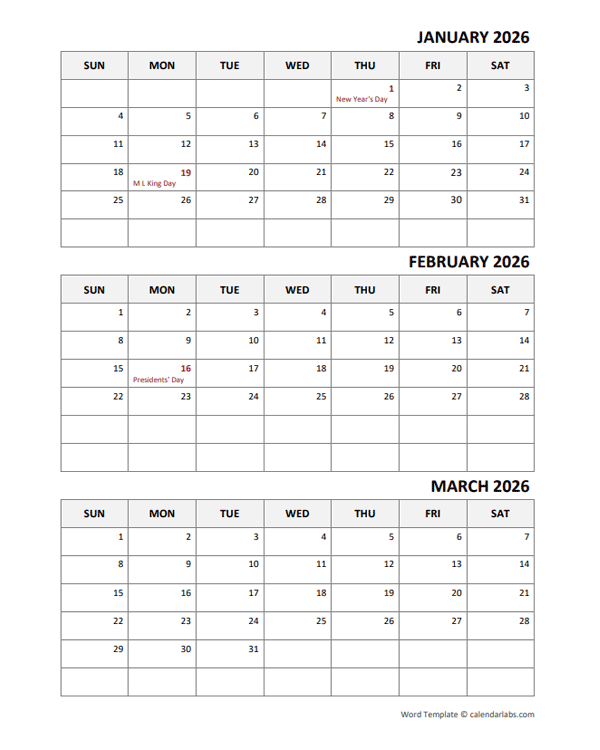

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Quarterly Word Calendar Template With Notes Free Printable Templates Due date for deposit of tax deducted/collected for the month of june, 2025. Tax calendar click here to view relevant act & rule.

Source: www.calendarpedia.com

Source: www.calendarpedia.com

Quarterly Calendars 2026 Free Printable Excel Templates This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. The due date for belated and revised.

Source: www.financialexpress.com

Source: www.financialexpress.com

Tax Calendar 2023 Full list of due dates and activities to be In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. The due date for belated and revised.

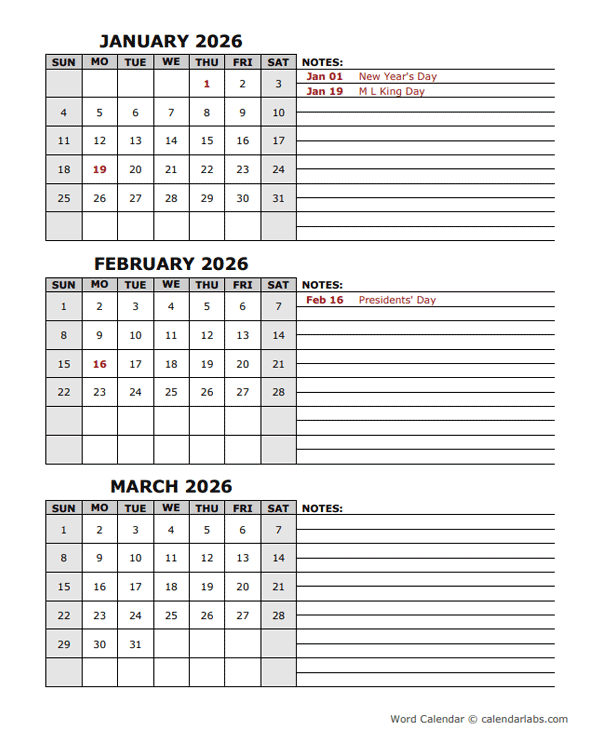

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Quarterly Word Calendar With Holidays Free Printable Templates Due date for deposit of tax deducted/collected for the month of june, 2025. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: www.generalblue.com

Source: www.generalblue.com

Q2 2026 Quarterly Calendar with United States Holidays (PDF, Excel, Word) The due date for belated and revised. Tax calendar click here to view relevant act & rule.