2026 To 2026 Tax Year Calendar Irs Unbelievable. Understanding the tax calendar is essential whether you’re a taxpayer or a tax professional. For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on.

For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. During this period, companies will plan their budgets, track expenses, and report financial performance based on this calendar. Tax day for the year 2026 is celebrated/ observed on wednesday, april 15.

Source: gwendolyncbooher.pages.dev

Source: gwendolyncbooher.pages.dev

A Comprehensive Guide To The Year 2026 April 2026 March 2027 For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. During this period, companies will plan their budgets, track expenses, and report financial performance based on this calendar.

Source: leroyhicks.pages.dev

Tax Year End 2026 Elisha Bertine You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each month.

Source: schedule2026.com

Source: schedule2026.com

Unlocking the IRS Refund Schedule 2026 What You Need to Know For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on. Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies).

Source: metabetageek.com

Source: metabetageek.com

Free 2026 Yearly Calendar Printable Plan Ahead! Printables for Everyone During this period, companies will plan their budgets, track expenses, and report financial performance based on this calendar. Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies).

Source: calendarforapril2026.pages.dev

Source: calendarforapril2026.pages.dev

Navigating The Fiscal Landscape Understanding The Government Fiscal Tax day is april 15th of each year (unless changed by federal government for that year) and marks the final day to file your income tax returns with the internal revenue service (irs). Tax day for the year 2026 is celebrated/ observed on wednesday, april 15.

Source: www.calendar.best

Source: www.calendar.best

2026 Calendar Calendar.best If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

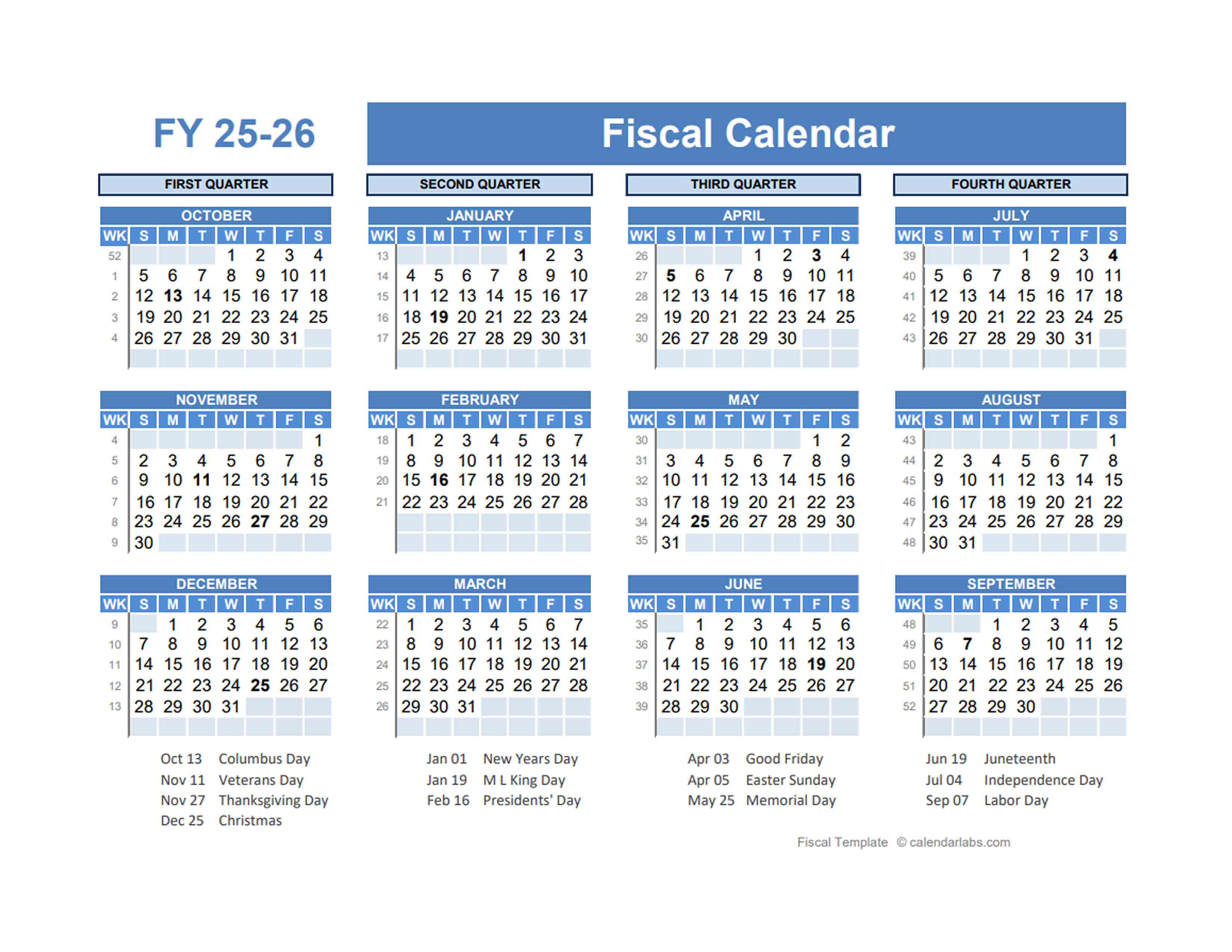

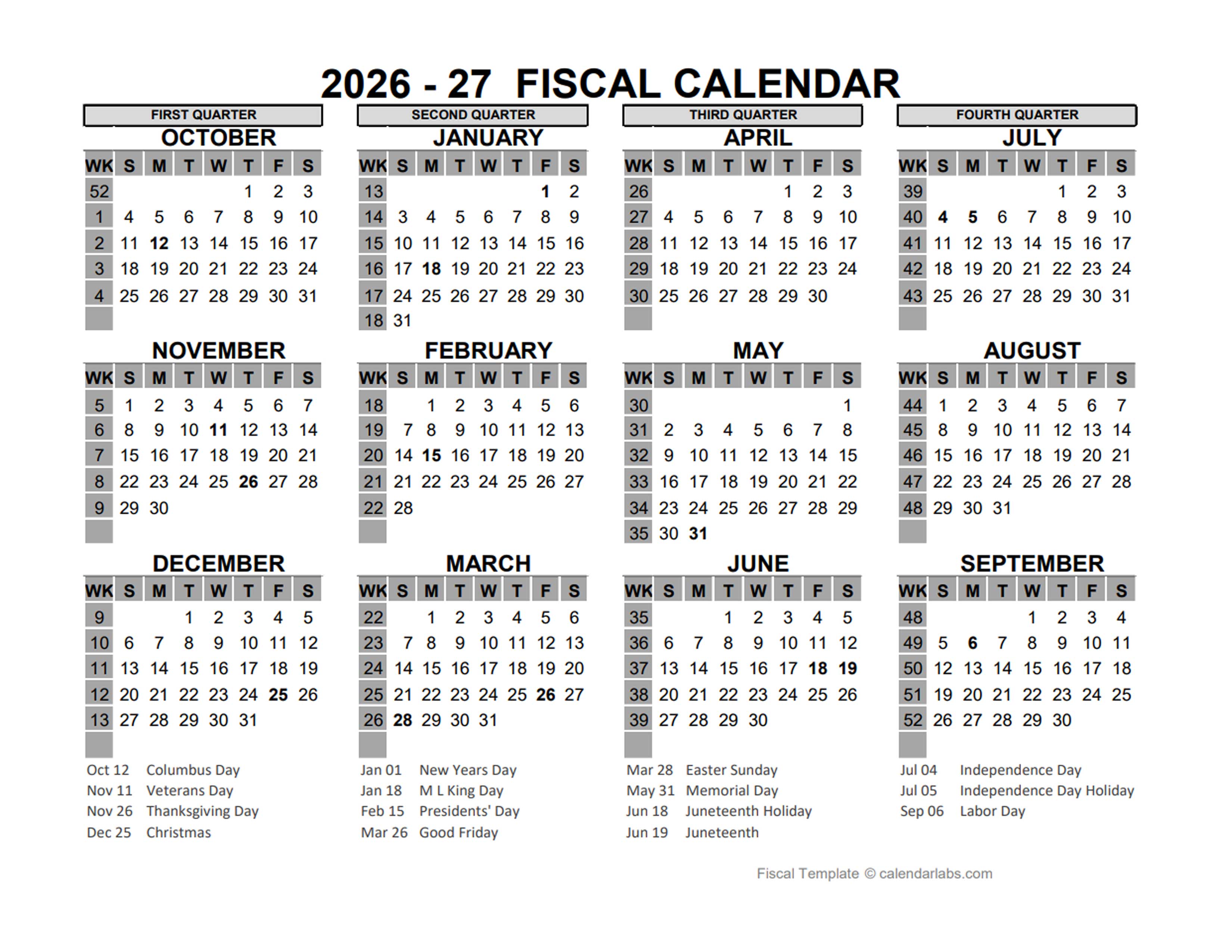

20262027 Fiscal Planner USA Free Printable Templates Tax day is april 15th of each year (unless changed by federal government for that year) and marks the final day to file your income tax returns with the internal revenue service (irs). Understanding the tax calendar is essential whether you’re a taxpayer or a tax professional.

Source: webpagecalendar.com

Source: webpagecalendar.com

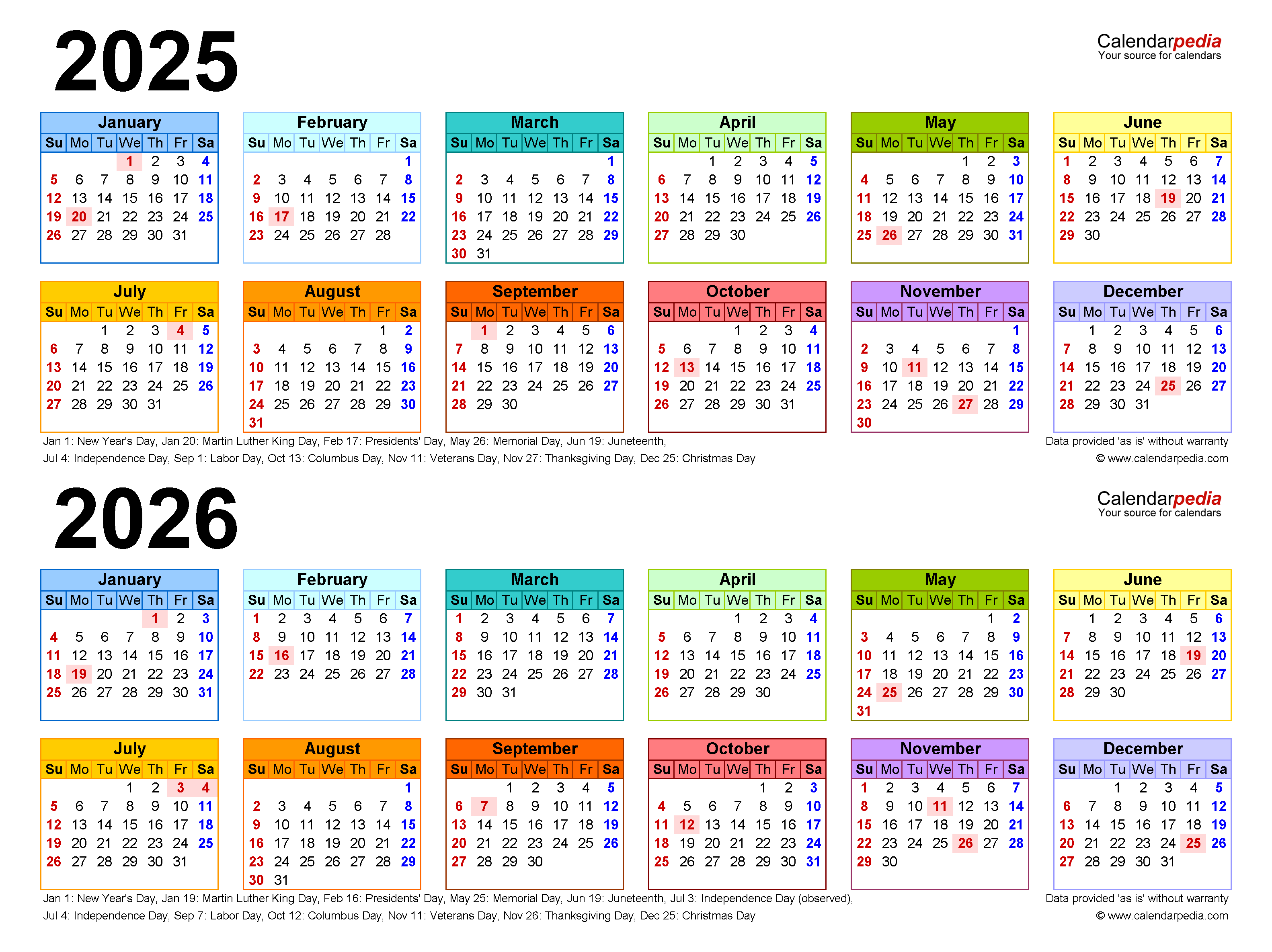

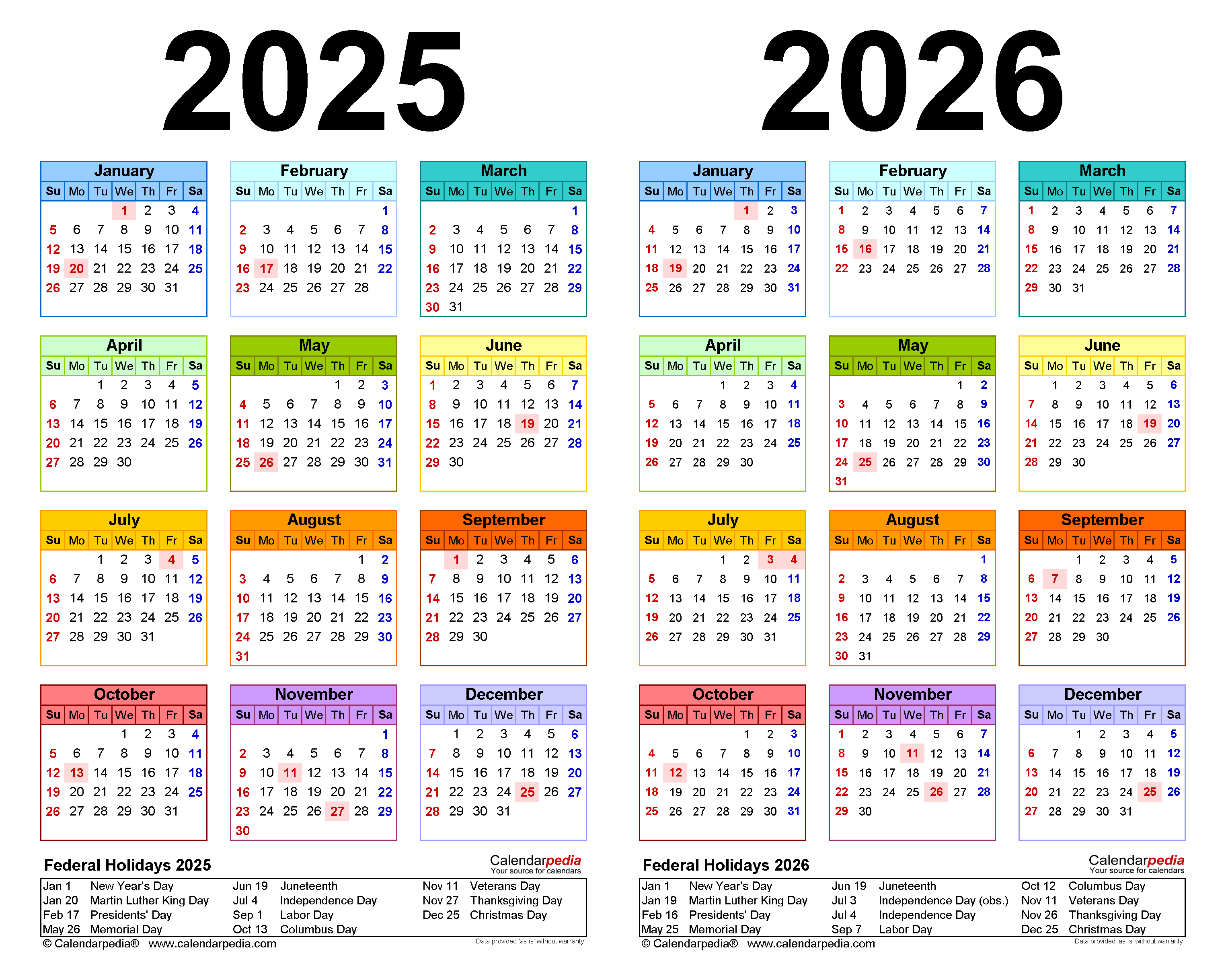

2025 2026 Two Year Calendar Free Printable PDF Templates Web Page If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each month.

Source: suncatcherstudio.com

Source: suncatcherstudio.com

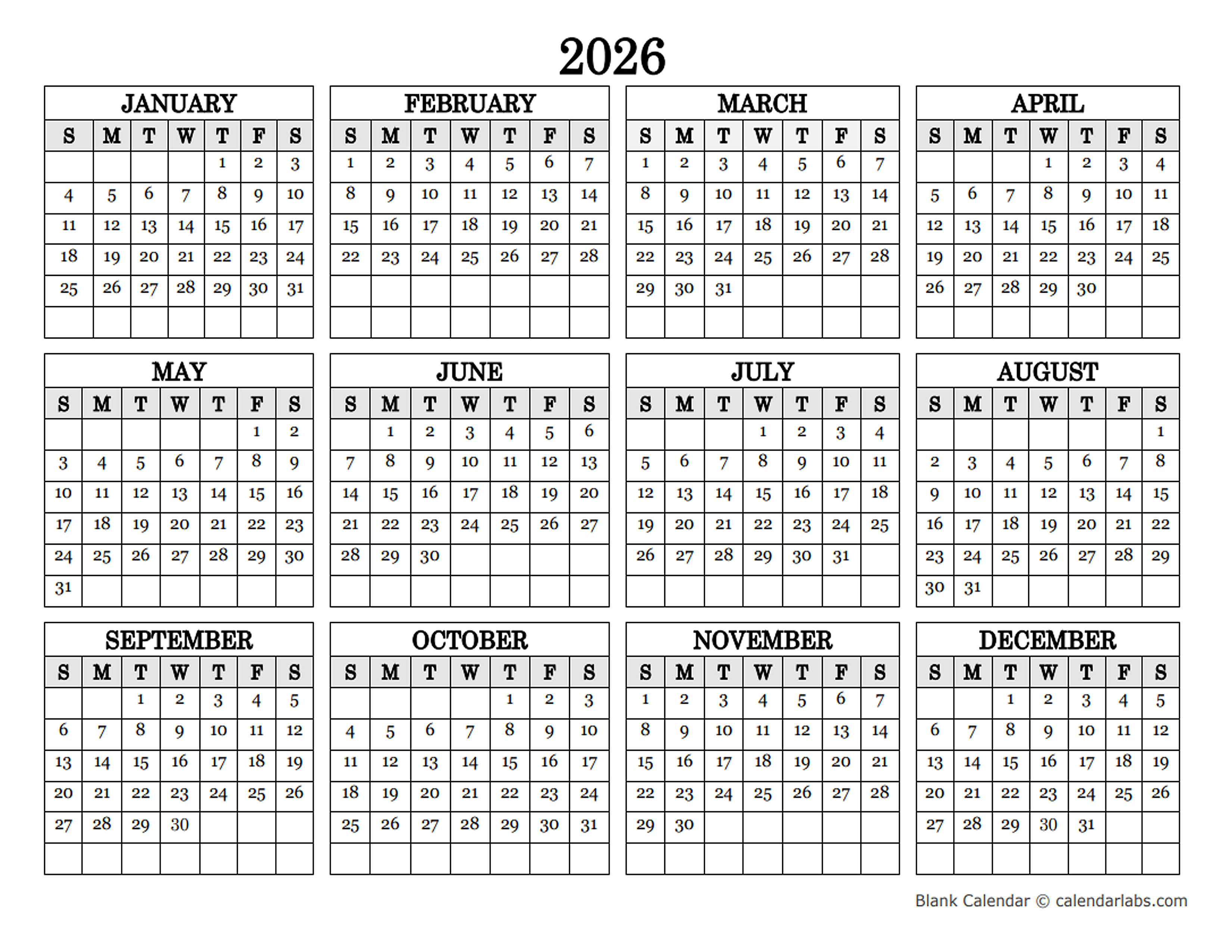

Free Printable 2026 Yearly Calendar Free Printables, Monograms If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. For the 2026 tax year (covering income earned in 2025), the season is expected to open in late january 2026 and end on.

Source: glentlopez.pages.dev

Source: glentlopez.pages.dev

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive During this period, companies will plan their budgets, track expenses, and report financial performance based on this calendar. Tax day for the year 2026 is celebrated/ observed on wednesday, april 15.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

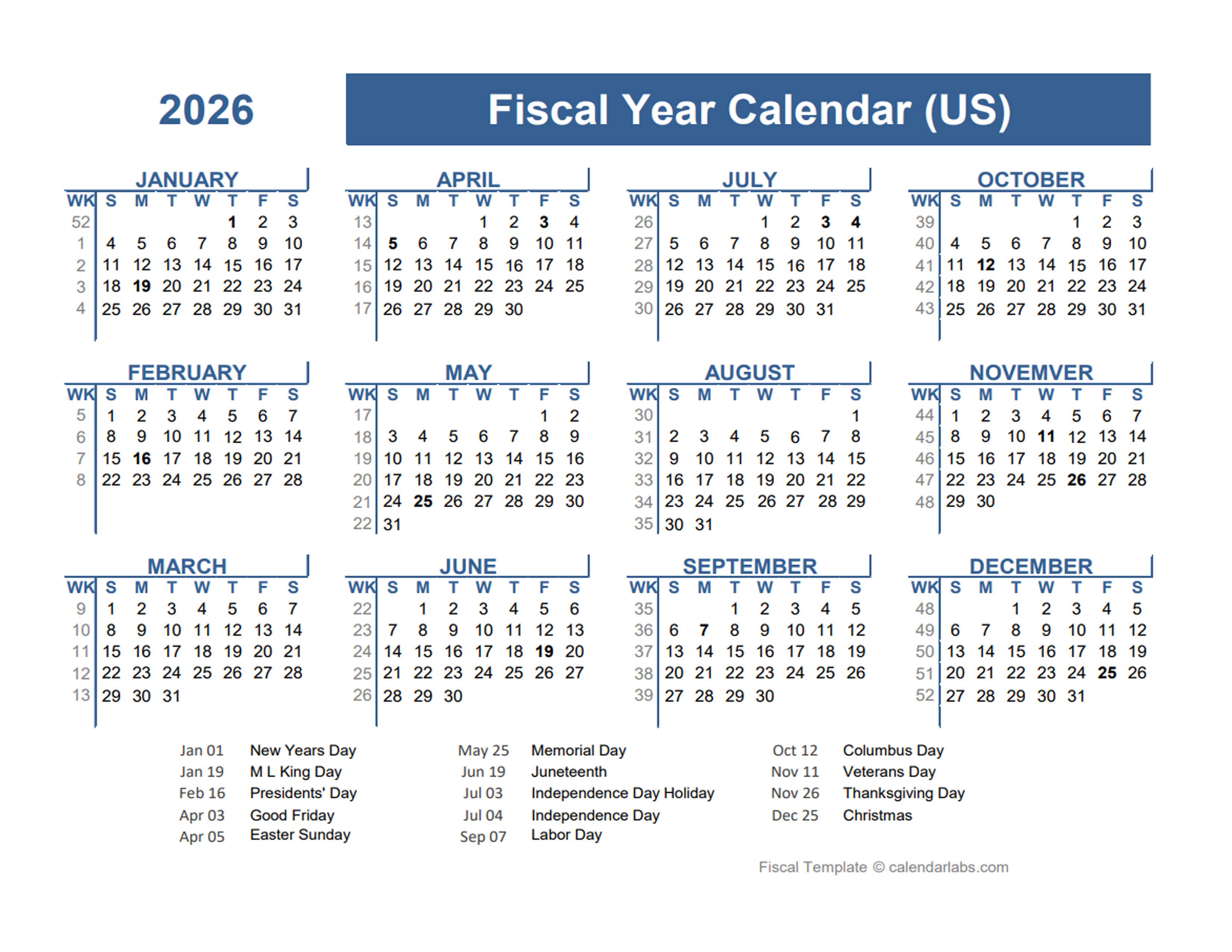

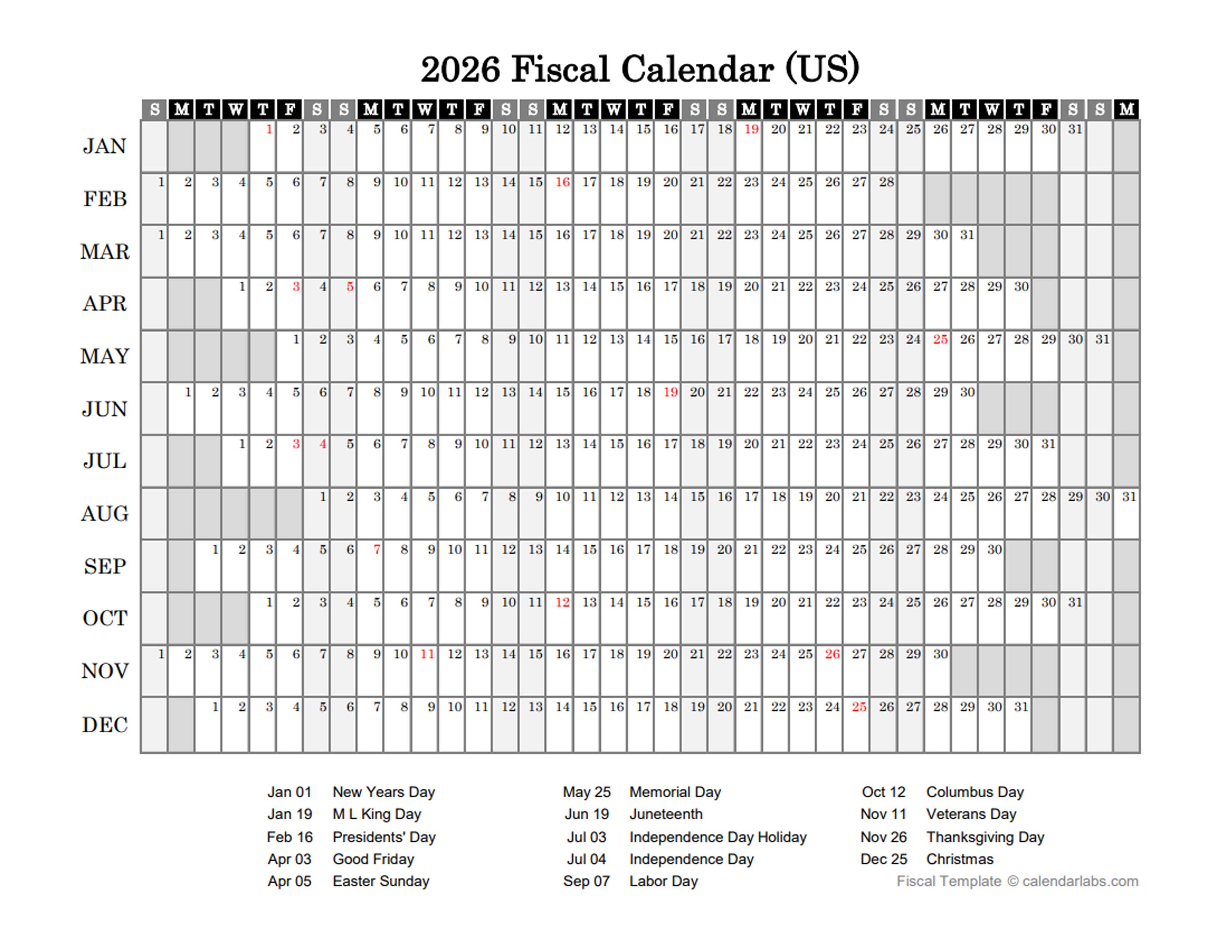

2026 US Fiscal Year Template Free Printable Templates If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. Likely the final day to file federal taxes unless the irs announces changes (e.g., due to holidays or emergencies).

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 Fiscal Calendar USA Free Printable Templates If you request an extension, your filing deadline moves to october 15, 2026, but taxes owed are still due by april 15, 2026 to avoid penalties or interest. Understanding the tax calendar is essential whether you’re a taxpayer or a tax professional.